THE NIXON PHONE BOOK

I just received my annual Nixon Phone Book, the insidiously helpful 2006-1040, Forms and Instructions for Overseas Filers (it's not something I admit to just anyone, but the fact is, I'm... I'm... an Overseas Filer), its officious thickness crammed with goodies like A Message from the Commissioner, Mark W. Everson: "Paying taxes is a pain in more than one place

I just received my annual Nixon Phone Book, the insidiously helpful 2006-1040, Forms and Instructions for Overseas Filers (it's not something I admit to just anyone, but the fact is, I'm... I'm... an Overseas Filer), its officious thickness crammed with goodies like A Message from the Commissioner, Mark W. Everson: "Paying taxes is a pain in more than one place It's nice of the Commissioner to spew niceties upon us from the other side of the world, but the fact is that I and many thousands of other US citizens in Japan will now have to spend big chunks of time - time we could have spent on actual living - getting all the forms together, then figuring out and filling out this monster, only to end up paying no taxes because we didn't earn a penny in the US. Is that Nixonian or what?

To say nothing of the billions of man/woman hours expended by those 200 million taxpayers in America, in terms of designing, creating, printing, mailing and processing the Nixon Phone Book, for zero return, the cost to the US taxpayer must be quite a bundle, but Mark never mentions anything about all that.

Then the "I am not a crook" Phone Book sets me pondering pointlessly whether as an expat I can maybe (as the cover so governmentally invites me to do) snag the credit for Federal Telephone Excise tax ("See the instructions for line 71 on page 60."), whether I should use the Alternative Minimum Tax Exemption Amount (can I pay less than zero?) and similar non-zen ponderings...

Anyway, it was in that taxing state of mind that I came across Your Real Tax Rate, an interesting article about what the already burdened US taxpayer actually pays:

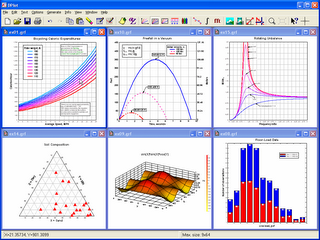

"Politicians rarely talk about what real people experience: the true maze of taxes and government benefits. If someone put them all together, we could see what our actual tax burden was. We could see who pays at the highest or lowest rates. Discussions of tax policy wouldn't be a waste of time.

"Well, two researchers did it...

"As a consequence, a 30-year-old couple earning only $20,000 a year has a marginal tax rate of 42.5%, while a 45-year-old couple earning $500,000 pays at 43.2%.”

Sounds fair.

As in that general mood of fairness I slog along through this stack of forms I can't help but contrast it with the tax system in Japan, where no company employee ever fills out a tax form. I've worked full-time here for 20 years and part-time for 7 years, and have never filled out a Japanese tax form; the company accountants take care of it. So for me I guess it all balances out. But I wonder if American voters will elect any politicians at all in 2008.